Revenue Cycle

The philosophy of Stratum’s Revenue Cycle Support services is to share best practices and select preferred vendors to enhance performance of our members’ Revenue Cycle. These services are the perfect networking opportunity to visit with peers about common challenges and successes, especially in the process improvement and vendor-related spaces. Additionally, Stratum also works on behalf of our members to negotiate Master Services Agreements, maximizing our volume to benefit member savings while also making the contracting process less burdensome for our end users.

lives

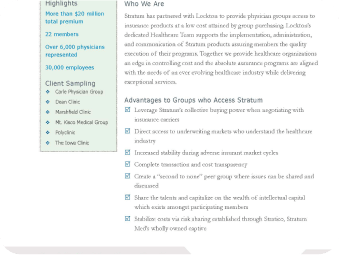

Stratum's Key Insurance Strategies

Achieve premium savings through aggregation and consolidation

Effectively track and manage brokerage commissions

Introduce enhanced coverage options unavailable to singular organizations

Guarantee rate stability even during adverse insurance market cycles

Optimize service and assurance accountability from our broker partners

Revenue Cycle Support

- Our philosophy is to share best practices and select preferred vendors to enhance performance of each Shareholder’s Revenue Cycle

- Host Quarterly Meetings

- Portfolio of Master Service Agreements with preferred vendors

Examples include:

- – Collections

- – Contract Management/Collections Optimization

- – Work Comp Collections

- – Health Services Financing

Stratum + Lockton = Success!

Insurance Brochure

Insurance Program Summary

Stand Alone Tail Program Brochure

Stratum's Chosen Broker

lockton

Lockton Companies actively provides comprehensive, affordable coverage to physician groups

and healthcare systems. Using the power of group purchasing, Lockton’s specialized healthcare

insurance department provides cutting-edge cost control and unwavering insurance assurance.

As Stratum’s national brokerage partner, Stratum members have access to Lockton’s breadth of

employee benefits, in-depth property and casualty services, and total risk management

solutions.

The Right Choice for the Healthcare Industry:

- A healthcare-specialized insurance broker can significantly enhance the quality and savings of your medical organizations' insurance coverage by offering

- Healthcare industry expertise working with health systems, physician groups, managed care organizations, and long-term care companies

- In-depth experience with all forms of alternative risk programs, captives, RRGs, and trusts Unparalleled client service and support

- Expansive reach, with more than 700 healthcare clients nationwide

- Excellent reputation with domestic and international underwriters